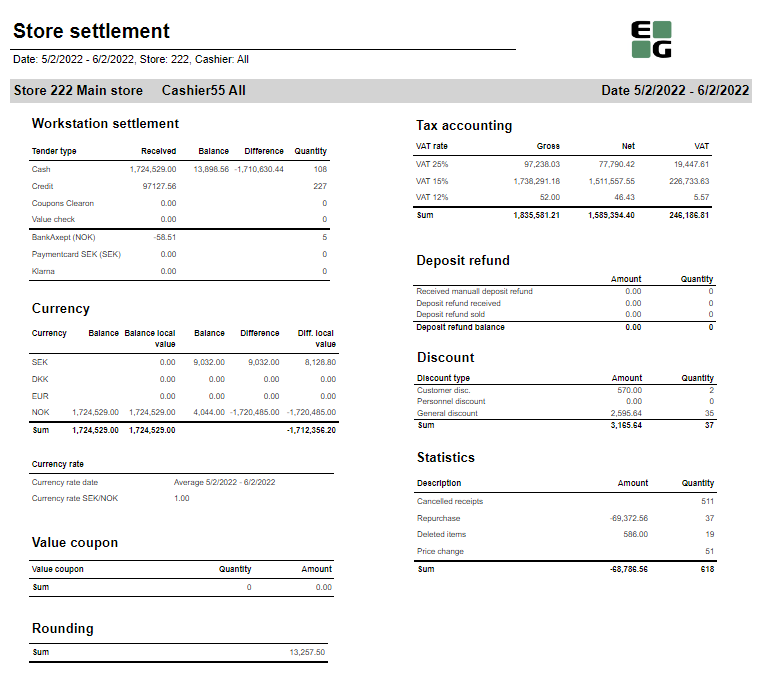

CO: 156791. Based on report 0709.

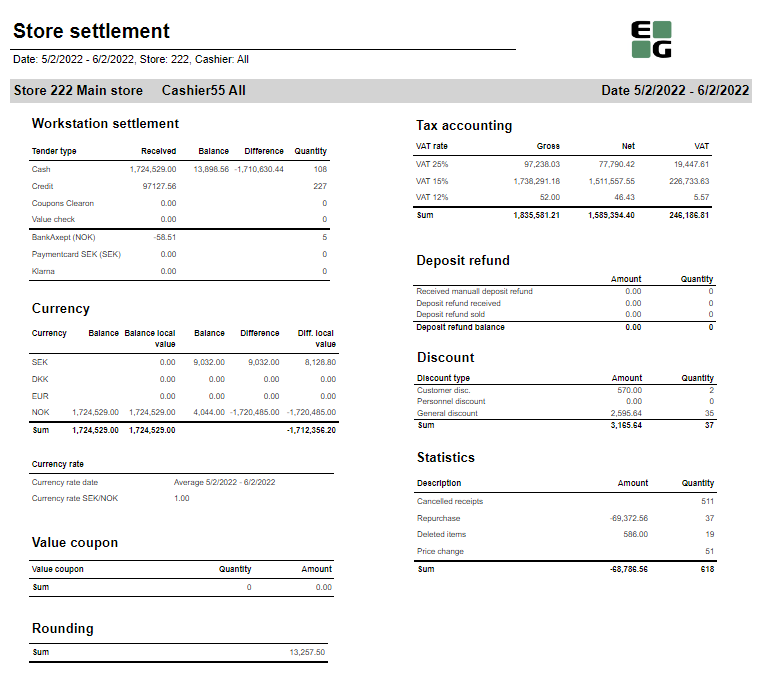

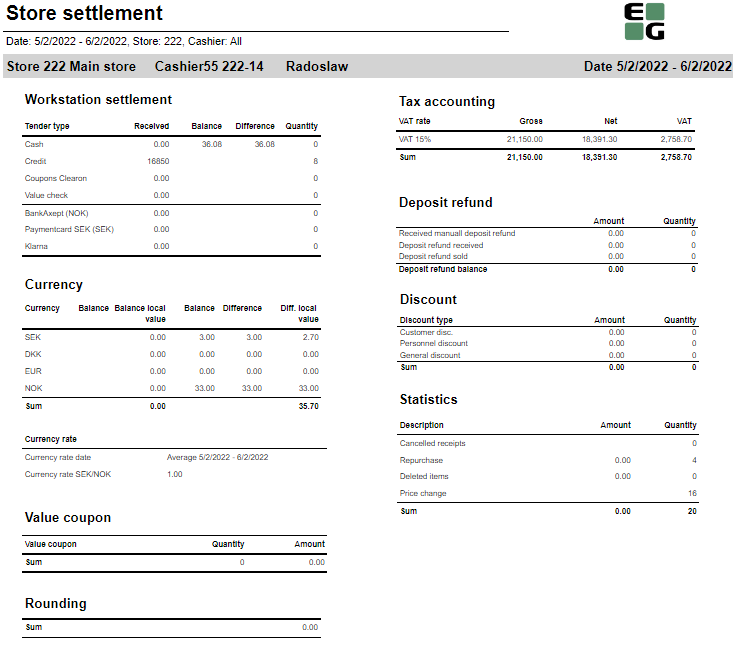

Description: Report allows to follow up store settlement: on first page settlement for all selected cashiers (if all cashiers are selected it equals whole store settlement) and settlement per each cashier on following pages. Report is divided in 9 subreports which will be descriped separatly below. Selections (applies to all subreports): - Date from - Default today

- Date to - Default today

- Store - Default all

- Operator -Default all

Subreports: | Expand |

|---|

|

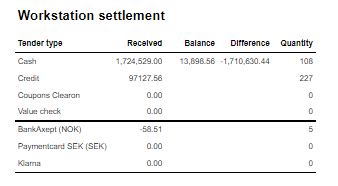

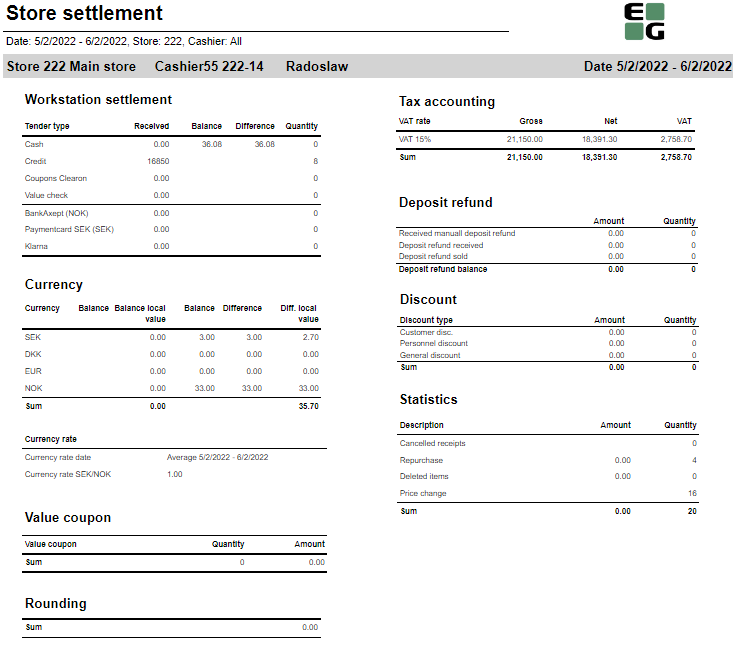

Columns: - Tender type - payment method

- Received - Sales amount inc. VAT received in given tender type

- Balance - Money amount registered in the end of the day (sum for selected operators who made balance and selected days)

- Difference - Balance - Received

- Qunatity - Number of items sold in given tender type

Output: One row per one tender type Clarifications: - Balance and Difference make sense only for cash since only cash it's kept in cash register.

|

| Expand |

|---|

|

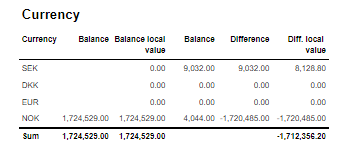

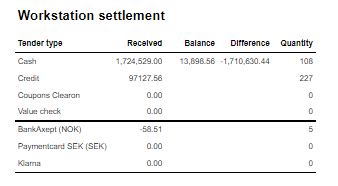

Columns: - Currency

- Balance (Beholdning): Sales amount inc. VAT in main currency

- Balance local value: Sales amount inc. VAT in received currency

- Balance (Oppgjør): Money amount registered in the end of the day in given currency (sum for selected operators who made balance and selected days)

- Difference: Balance (Oppgjør) - Balance (Beholdning)

- Diff. local value: Balance (Money amount registered in the end of the day) in main currency - Balance local value

|

| Expand |

|---|

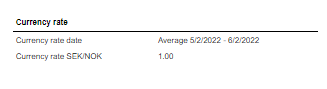

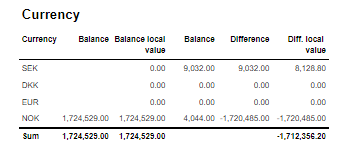

| title | 1423_subCurrencyRate |

|---|

|

Description: Average currency rate (rigidly set to SEK/NOK) for given period.

|

| Expand |

|---|

|

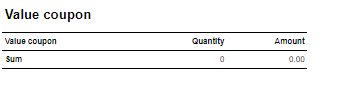

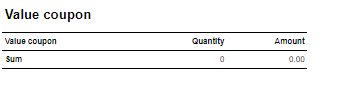

Description: This subreport shows sum sales amount inc. VAT and sales sum quantity for EAN set in hidden parameter: pValueCouponEAN (default: 926)

|

| Expand |

|---|

|

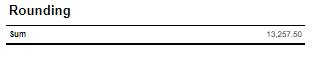

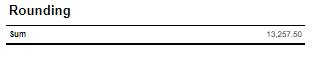

Description: Sum of all transactions subtotal rounding (for given period, store and operators) |

| Expand |

|---|

|

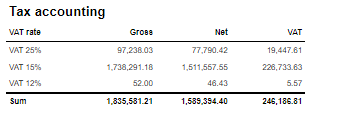

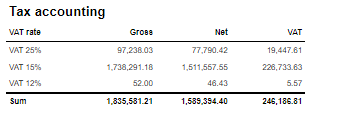

Coumns: - Gross: Sales amount inc. VAT

- Net: Sales net amount

- VAT

Output: One row per sum one type of VAT. Vaules are summed for given store, date period and operators

|

| Expand |

|---|

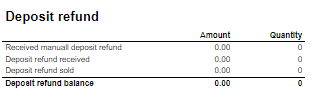

| title | 1405_subDepositRefound |

|---|

|

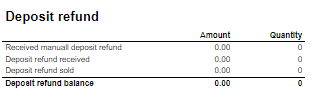

Columns: - Amount: Sales amount inc. VAT

- Qunatity: Number of receipts.

OutputRows: - Received manuall deposit refund: Sales Amount for returns, etc. (direction in; only received; not including returns etc.) per item group set in hidden parameter: pArtGrpManualDepositRefundIn (default: 502)

- Deposit refund received: Sales Amount for returns, etc. (direction in; only received; not including returns etc.) per item group set in hidden parameter: pArtGrpDepositRefundIn (default: 501)

- Deposit refund sold: Sales (direction out) per item group set in hidden parameter: pArtGrpDepositRefundSold (default: 500)

- Deposit refund balance: sum of 3 values above

|

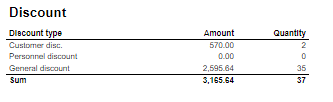

| Expand |

|---|

|

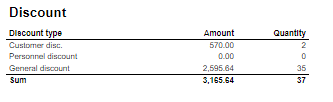

Coulmns: - Amount: Discount amount

- Quantity: Number of receipts with discount

Rows: - Customer disc.: discount with discount key: CustomerGroup

- Personnel discount: discount for employees with discount key: Subtotal

- General discount: discount with key: Line

|

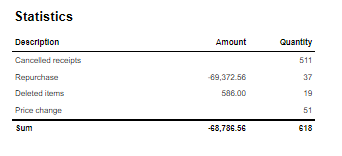

| Expand |

|---|

|  Image Added Image Added

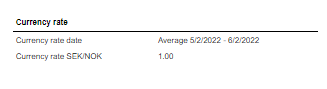

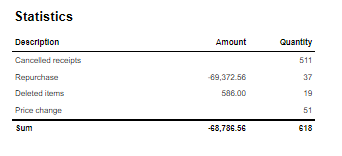

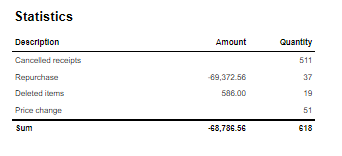

Columns: - Amount: Sales amount inc. VAT (valid only for Repurchase and Price change)

- Qunatity: Number of receipts for Cancelled receipts and Repurchase; number of items for Deleted items and Price change

Rows: - Cancelled receipts: Number of deleted/cancelled receipts

- Repurchase: All returns except those for item groups set in hidden parameters: pArtGrpManualDepositRefundIn (default 502) and pArtGrpDepositRefundIn (default 501)

- Deleted items: Items from Cancelled receipts

- Price change: Number of items sold with changed price

| | Expand |

|---|

|  Image Removed Image Removed |

Source: - Lindbak POS Reporting cube (OLAP)

|