Description: Report allows to follow up store settlement: on first page settlement for all selected workstations (if all cashiers are selected it equals whole store settlement) and settlement per each workstation on following pages. Report is divided in 15 subreports which will be descriped separatly below. Selections (applies to all subreports): - Date from: Default today

- Date to: Default today

- Store: Single value; default first available from the list.

- Workstation: Multivalue; default all

Subreports:

| Expand |

|---|

|

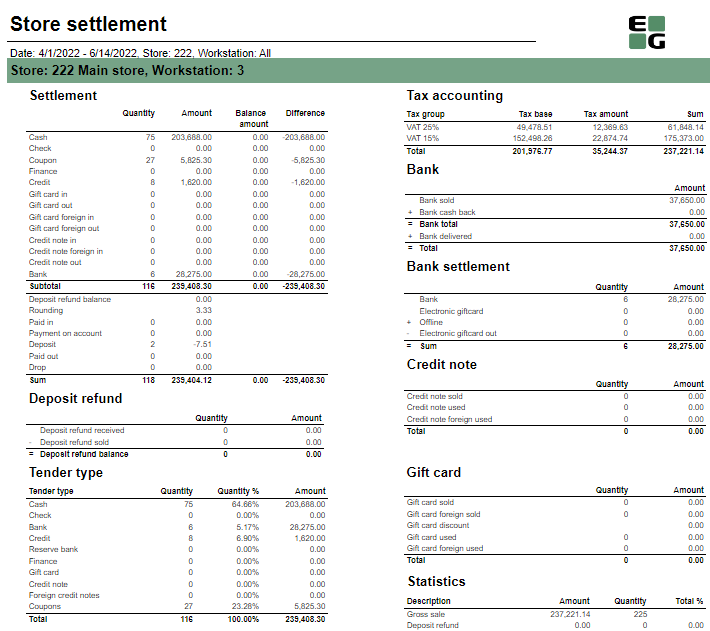

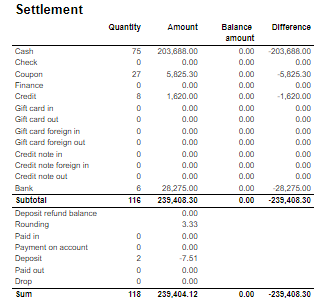

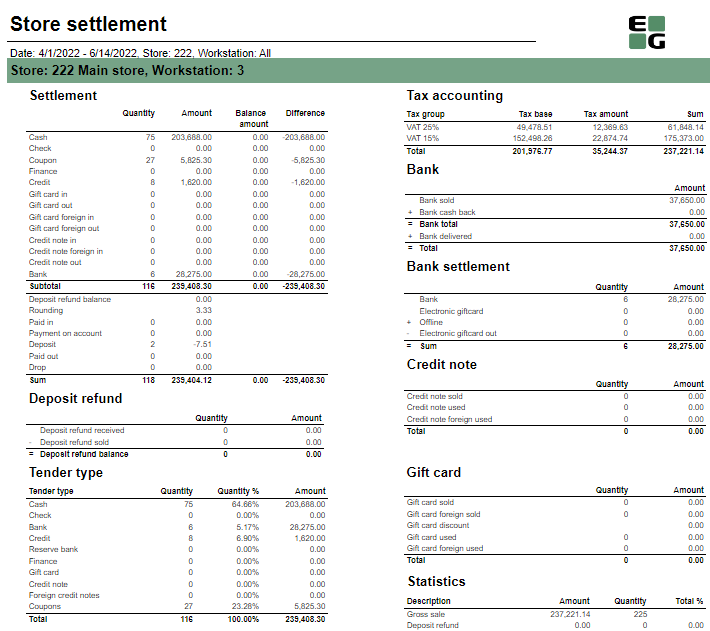

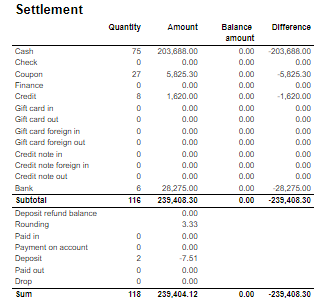

Columns: - Quantity

- Amount

- Balance amount

- Difference: Balance amount - Amount

Rows: One row per tender type . In means received, out means given (returns etc...) - Cash: Tender type key = Cash or CashBack

- Check

- Coupon

- Finance

- Credit

- Gift card in

- Gift card out

- Gift card foreign in

- Gift card foreign out

- Credit note in

- Credit note foreign in

- Credit note out

- Bank: Tender Type Key = CreditDebit or CreditDebitOffline or ECreditDebit

- Subtotal: Total for all rows above Subtotal

______________________________________________________________________________________ - Deposit refound balance: Tender type key DepositRefund received - DepositRefund given

- Rounding: Subtotal rounding

- Paid in: Tender Control Type Key: PayedIn

- Payment on account: Tender Control Type Key: PaymentOnAccount

- Deposit: Article Type Key: Deposit

- Paid out: Tender Control Type Key: PayedOut

- Drop: Tender Control Type Key: Drop

|

| Expand |

|---|

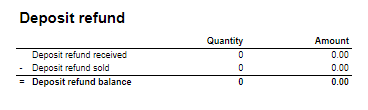

| title | 1005_subDepositRefund |

|---|

|

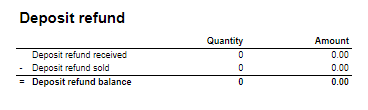

Columns: - Amount: Sales amount inc. VAT

- Qunatity: Number of receipts.

Rows: - Deposit refund received: Amount (or number of receipts) for direction in for Article Type Key: DepositRefund

- Deposit refund sold: Amount (or number of receipts) for direcion out for Article Type Key: DepositRefund

- Deposit refund balance: Received - sold

|

| Expand |

|---|

|

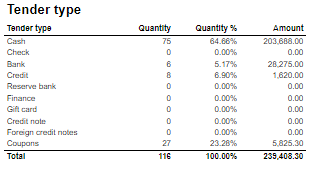

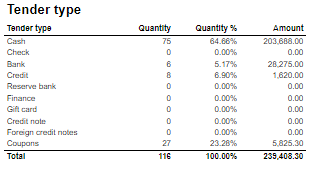

Columns: - Qunatity

- Qunatity %: Share of given tender type quantity in whole quantity

- Amount: Sales inc. VAT per tender type

Rows: - One row per one tender type

|

| Expand |

|---|

|

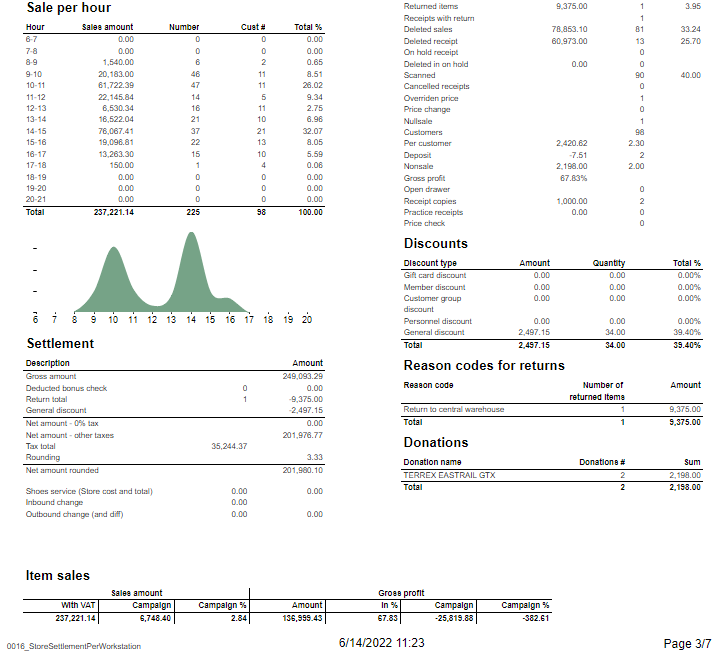

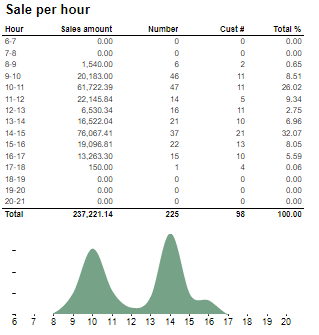

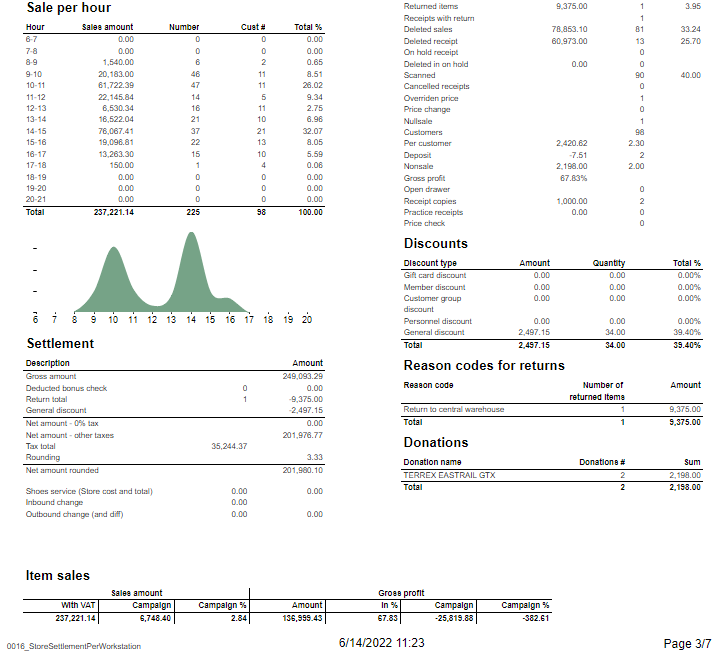

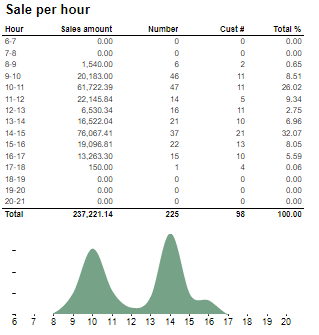

Description: Sales statistics hour by hour with graph showing sales Amount. Columns: - Hour

- Sales amount: sales inc. VAT

- Number: sold quantity

- Cust #: number of receipts

- Total %: Share of sales amount per hour in whole sales amount

Rows: - one row per hour with total in the end

|

| Expand |

|---|

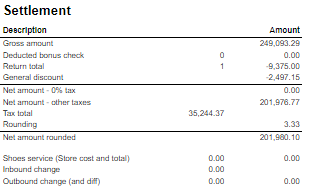

| title | 1008_subSettlement_2 |

|---|

|

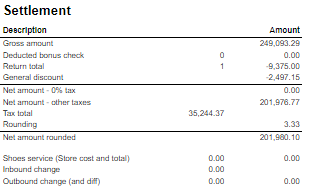

Rows: - Gross amount: Amount inc. VAT + General discount - Returns

- Deducted bonus check: Return amount on article group set in hidden parameter: pBonusCheckArticleGroup

- Return total: All rerutns amount - Deducted bonus check

- General discount: Discount amount with keys: Line and Subtotal

__________________________________________________________________________________ - Net amount - 0% tax: Net amount with 0% tax

- Net amount - other taxes: Net amount

- Tax total: tax amount

- Rounding: Subtotal rounding amount

__________________________________________________________________________________ - Net amount rounded: both Net amounts + Rounding

- Shoes serviece (Store cost and total): balance amount with tender type: InboundChangeBalance; Sales inc. VAT per article with article type: Service

- Inbound change: Return amount per article with article type: Service

- Outbound change: Remaining Amoun tIn Drawer; difference: Remaining Amoun tIn Drawer - balance amount with tender type: InboundChangeBalance

|

| Expand |

|---|

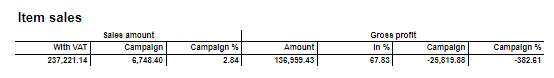

| title | 1000_subArticleSales |

|---|

|

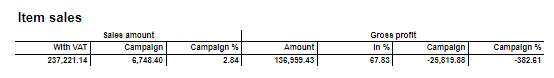

Columns: - Sales amount With VAT:

- Sales amount Campaign: Sale amount inc. VAT for campaigns with discount keys: CampaignPrice, Group, MemberPrice

- Sales amount campaign %: Share of campain sales in all sales (Sales amount Campaign / Sales amount With VAT)

- Gross profit Amount

- Gross profit In %: Share of Gross profit in Net Amount

- Gross profit Campaign: Gross profit for Campaign

- Gross profit Campaign %: Share of gross profit for campains in campaign sales (Gross profit Campaign/ Sales amount Campaign)

Rows: |

| Expand |

|---|

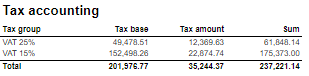

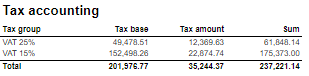

| title | 1012_subTaxAccounting |

|---|

|

Columns: - Tax group: tax type

- Tax base: Net amount

- Tax amount: tax

- Sum: Turnover inc. VAT

Rows: |

| Expand |

|---|

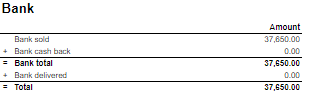

|

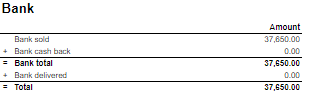

Rows: - Bank sold: Sales amount for tender types: CreditDebit, CreditDebitOffline, ECreditDebit

- Bank cash back: tender type Cash back

- Bank delivered: tender type: DeliveredBalance

|

| Expand |

|---|

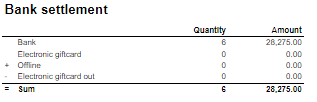

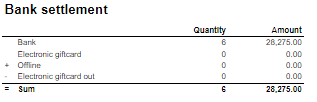

| title | 1003_subBankSettlement |

|---|

|

Rows: - Bank: Amount for tender types: CreditDebit, CreditDebitOffline, ECreditDebit, Cash back

- Electronic giftcard: Amount for few hard coded payment card keys

- Offline: Amount for CreditDebitOffline

- Electronic giftcard out: Outcoming amount for few hard coded payment card keys

|

| Expand |

|---|

|

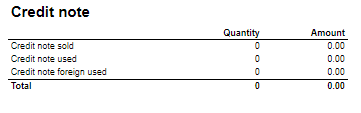

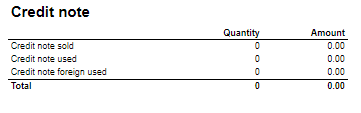

Rows: - Credit note sold: Quantity/ Amount of sold by store credit notes

- Credit note used: Credit notes used in the store

- Credit note foreign used: Foreign credit notes used in the store

|

| Expand |

|---|

|

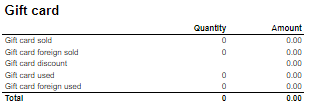

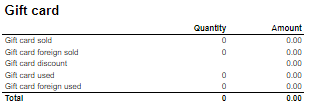

Columns: - Quantity: number of gift cards

- Amount: Amount on gift cards

Rows: - Gift Card sold: Gift cards sold by given operator in given store

- Gift card foreign sold: Foreign gift cards sold by given operator in given store

- Gift card discount

- Gift card used: Sales amount inc. VAT made with gift cards. (Number of transactions made with gift cards)

- Gift card foreign used: Sales amount inc. VAT made with foreign gift cards. (Number of transactions made with foreign gift cards)

|

| Expand |

|---|

|

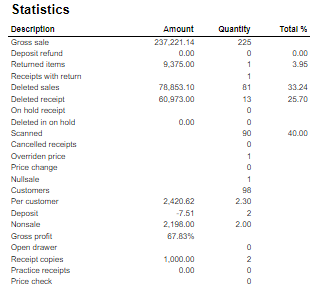

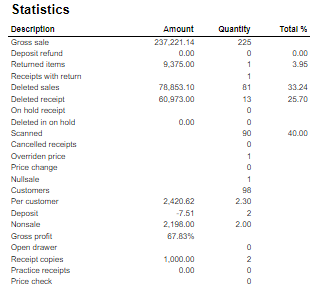

Rows: - Gross sale amount: Amount inc. VAT

Total%: - Deposit refund: Deposit refound amount / Gross sale amount

- Returned items: Returned items amount/ Gross sale amount

- Deleted sales: Deleted amount/ Gross sale amount

- Deleted reciept: Deleted receipts amount/ Gross sale amount

- Scanned: Scanned quantity/ Gross sale qunatity

|

| Expand |

|---|

|

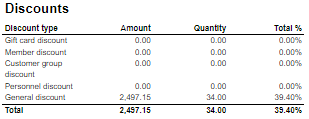

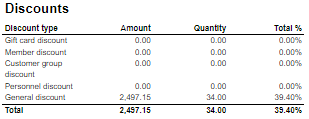

Columns: - Amount: Discount amount

- Quantity: quantity of items sold with given discount

- Total %: Share of given discount amount in all discounts amount

Rows: - One row per one type of discount

|

| Expand |

|---|

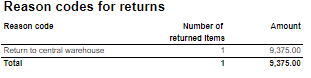

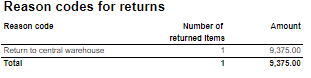

| title | 1014_subReturnReasonCodes |

|---|

|

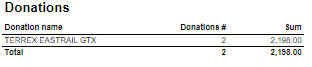

Description: Amount inc. VAT and quantity of items returned. One row per reason code. |

| Expand |

|---|

|

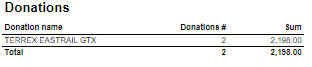

Description: Nonsale Amount and number of transactions per article. Clarification: Articles to displayed can be narrowed down by changing parameter: pArticlesSet |

Source: - Lindbak POS Reporting cube (OLAP)

|