Turnover rent is the net rent that is determined according to the turnover of the business carried out in the premises.

The turnover rent can be determined, for example, in the following way: The minimum rent is x euros (the maximum rent can also be determined, if required).

The rent is x percent of the turnover but no less than the minimum rent and no more than the maximum rent.

Here, ‘turnover’ is understood to mean net sales exclusive of taxes and adjustment items.

Entering turnover rent on an agreement

Base rent used in the turnover rent agreement is derived from the objects of lease added to the agreement, and it cannot be modified here.

Turnover rent is determined by comparing the turnover component to the base rent or by adding it to the base rent.

Enter the percent of turnover required, and if needed, the maximum amount for the turnover rent (you can determine a separate rent adjustment for this).

The turnover to be used for each invoicing period must be specified. For instance, this may be the turnover x months before the due date of the invoice, or the last turnover entered.

By clicking on the + sign next to the text Turnover rent, you can fill out the details for the turnover rent.

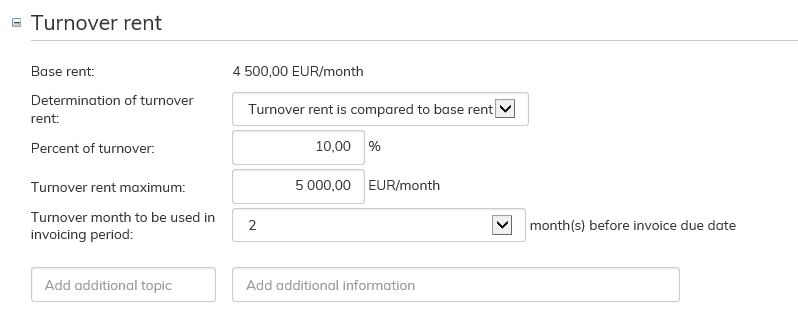

Example 1: The base rent for the rental areas is EUR 4 500 per month. The turnover rent is determined as follows: The turnover rent is compared to the base rent. The percentage is set at 10% of the turnover. The maximum rent is set at EUR 5 000 per month, with rent adjustment according to the agreement. When invoicing, the base rent is compared to the turnover 2 months before the invoicing period, i.e. the turnover for May is used for July’s invoicing. If the turnover for May is EUR 50 000, 10% of this is EUR 5,000. As this percentage exceeds the base rent of EUR 4 500, it will be used in invoicing.

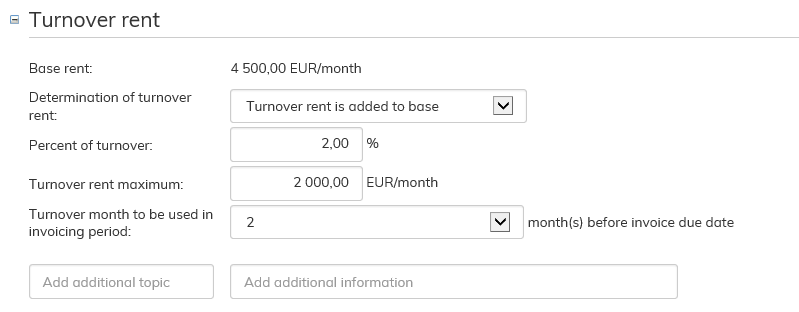

Example 2: The base rent for the rental areas is EUR 4 500 per month. The turnover rent is determined as follows: The turnover is added to the base rent. The percentage is set at 2% of the turnover. The maximum rent is set at EUR 2 000 per month, with rent adjustment according to the agreement. When invoicing, the base rent is compared to the turnover 2 months before the invoicing period, i.e. the turnover for May is used for July’s invoicing. If the turnover for May is EUR 100 000, 2% of this is EUR 2 000. Thus, the total invoicing amount in euros is 4 500 + 2 000 = 6 500.

Updating turnover in the system

Instructions under Turnover update describe how the turnovers used for calculating the turnover rent are maintained in Optimaze.